notary public fees : forecast your costs

BAUM NOTAIRES offers you two calculation tools designed by the paris chamber of notaries public. they allow you to calculate the fees for a purchase and release from mortgages etc.

How are notary public fees calculated?

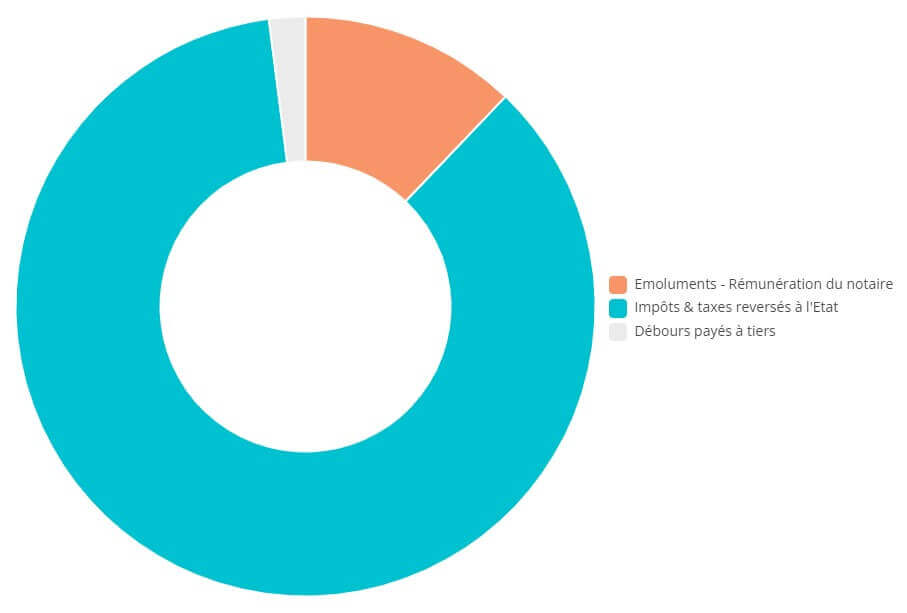

- Emoluments (Fees): The proportional rate is 0.814% of the value of the transaction, i.e. Émolument excluding tax of €4,487, to which VAT is added at a rate of 20%, making a total of approximately €5,500 inclusive of taxes.

- Costs: For the purpose of the example we shall take a flat rate of €1,000.

- Taxes and duties: The sale of a building is subject to registration duties at a rate of 5.8% of the value of the transaction, to which is added a further contribution de sécurité immobilière [French property transaction formalities fee] at a rate of 0.1%, making a total amount for taxes and duties to be paid of roughly €29,500.

All of the notary public fees that you would need to pay for this real estate sale can be represented as follows:

Ask your notary public for a provisional statement of fees. Only they will be able to give you exact information and detailed explanations. Calculate your notary public fees using the simulator offered by the Firm.

Understanding “notary public fees”

The “frais de notaires” or “frais d’acquisition” associated with the signature of any certified deed in France refer to all of the amounts that are invoiced by the notary public.

In actual fact, these terms cover three different expenses:

- Payment for the notary public,

- The costs that are paid to third parties, and

- The duties, taxes and contributions that are paid to the State.

Payment for the notary public

In the context of a certified deed, notaries public may receive two types of remuneration: émoluments or honoraires.

Emoluments

In view of the status of notaries public and in order to ensure the equality of all citizens in terms of the legal instruments requiring work by a public official (real estate sales, marriage contracts, declarations of succession, etc.), the authorities have defined a national tariff that applies to all notaries and their customers.

Émoluments are either proportional to the value of the transactions covered by the instrument or are fixed. The amount of the remuneration and the calculation method are stipulated by law.

Therefore, all customers pay the same amount for the same transaction, regardless of their resources, the complexity of the case, the experience or the position of the notary public.

VAT of 20% applies to émoluments.

Honoraires

For instruments and services that are not covered by this tariff, notaries public can invoice honoraires from their customers. Honoraires are set by mutual agreement between the notary and their customers. This remuneration applies in particular for commercial leases, corporate law, businesses, etc.

VAT of 20% applies to honoraires.

Costs

In the course of preparing your file, notaries public work with different participants who are tasked with producing the documents required for the transaction (land registration, town planning, administration, co-owners’ property manager, expert surveyor, etc.).

The notary public pays the fees to these participants on behalf of their customers.

The costs that you pay to the notary public actually cover these expenses.

The duties, taxes and contributions that are paid to the state

Before the sale, the notary public sends you an “état prévisionnel de frais” (provisional statement of fees) assessing the different expenses (fees, costs, taxes) that you must pay on the date of signature.

On the day of the sale, you pay the notary public a “provision”.

The final costs will be known after the performance of all of the formalities resulting from the signature of the instrument.

Your notary public then sends you an invoice and prepares a final balance, reimbursing you for any excess paid for the provision or asking you to pay any outstanding amounts if the provision was inadequate.